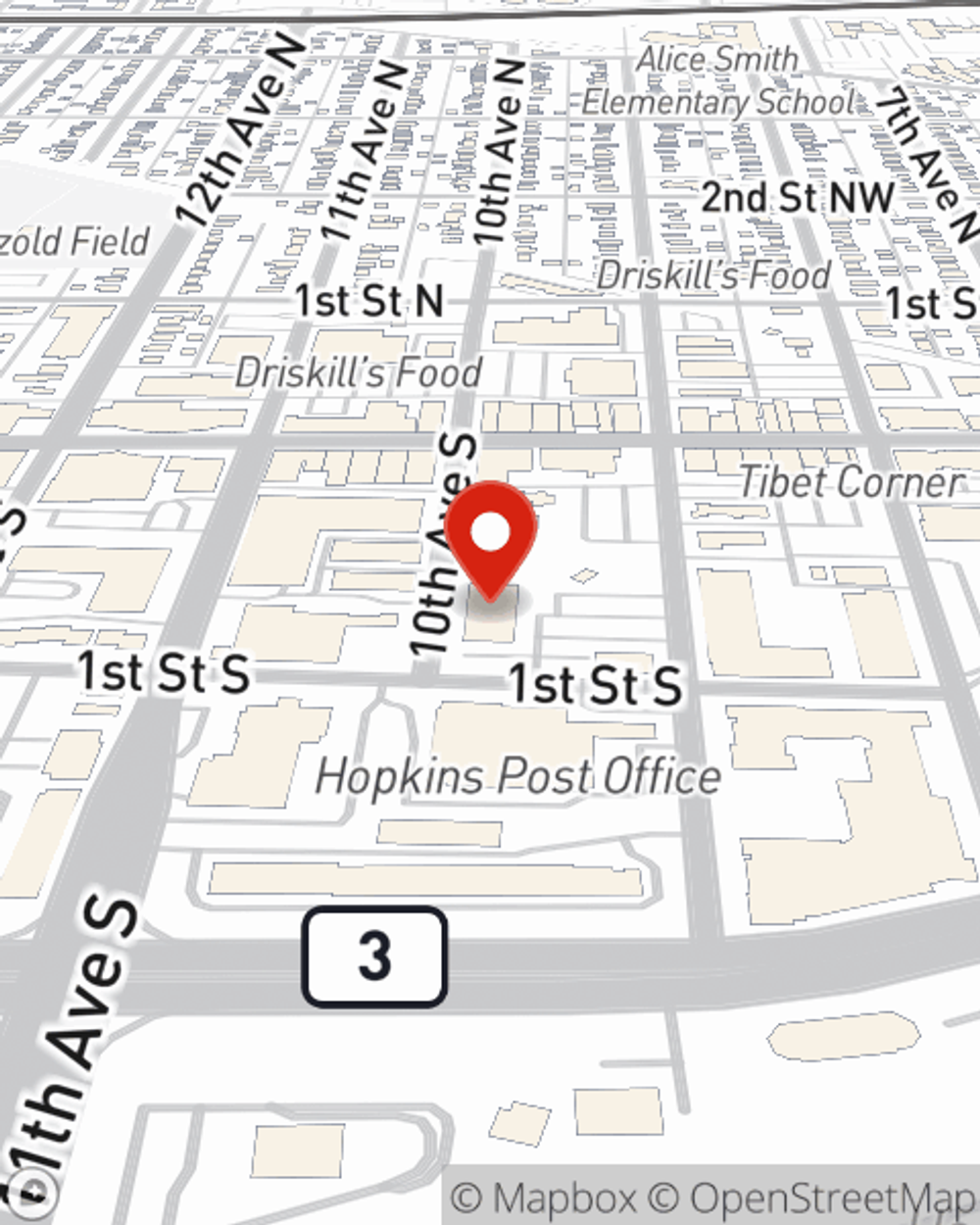

Homeowners Insurance in and around Hopkins

A good neighbor helps you insure your home with State Farm.

Help protect your home with the right insurance for you.

Would you like to create a personalized homeowners quote?

- Hopkins

- Minneapolis Area

- ST Paul Area

- Southern Metro Area

- Northern Metro Area

- Western Metro Area

- Hennepin County Area

- State of Minnesota

- State of Wisconsin

- Eden Prairie

- Minnetonka

- Edina

- St Lous Park

- Excelsior

- Bloomington

- Plymouth

Home Is Where Your Heart Is

Being at home is great, but being at home with protection from State Farm is the ultimate luxury. This fantastic coverage is more than just precautionary in case of damage from blizzard or windstorm. It also has the ability to protect you in certain legal situations, such as someone getting hurt in your home and holding you responsible. If you have the right coverage, your insurance may cover these costs.

A good neighbor helps you insure your home with State Farm.

Help protect your home with the right insurance for you.

Safeguard Your Greatest Asset

Protection for your home from State Farm is a great next step. Just ask your neighbors. And reach out to agent Jim Lindahl for additional assistance with choosing the right level of coverage.

As a dependable provider of home insurance in Hopkins, MN, State Farm helps you keep your valuables protected. Call State Farm agent Jim Lindahl today and see how you can save.

Have More Questions About Homeowners Insurance?

Call Jim at (952) 545-6400 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

What to do after an earthquake

What to do after an earthquake

Steps to stay safe after an earthquake and ways to help protect your property.

Jim Lindahl

State Farm® Insurance AgentSimple Insights®

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

What to do after an earthquake

What to do after an earthquake

Steps to stay safe after an earthquake and ways to help protect your property.